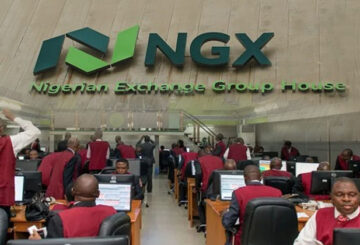

Nigerian equities traded almost on the balance last week as first-half earnings renewed investors’appetite for quoted shares. Benchmark indices at the Nigerian Stock Exchange (NSE) showed a marginal drop of 0.003 per cent last week, leaving the average year-to-date return almost unchanged at -11.17 per cent.

Nigerian equities traded almost on the balance last week as first-half earnings renewed investors’appetite for quoted shares. Benchmark indices at the Nigerian Stock Exchange (NSE) showed a marginal drop of 0.003 per cent last week, leaving the average year-to-date return almost unchanged at -11.17 per cent.

The All Share Index (ASI)- the common value-based index that tracks share prices at the Exchange, closed weekend at 27,918.59 points as against its week’s opening index of 27,919.50 points. Aggregate market value of quoted equities also slipped from its week’s opening value of N13.607 trillion to close weekend at N13.606 trillion.

With 31 advancers to 29 decliners, the market performance was buoyed by the release of interim earnings reports by several companies. NPF Microfinance Bank led the advancers, in percentage terms, with a gain of 14.16 per cent to close at N1.29 per share. BOC Gases followed with a gain of 11.67 per cent to close at N5.07. Lafarge Africa rose by 11.2 per cent to close at N14.40. Neimeth International Pharmaceuticals appreciated by 10 per cent to close at 55 kobo while Nigerian Aviation Handling Company rose by 9.36 per cent to close at N2.57 per share.

On the negative side, Linkage Assurance led the decliners with a loss of 20.31 per cent to close at 51 kobo. International Breweries dropped by 18.3 per cent to close at N12.50. Forte Oil declined by 10.67 per cent to close at N18. Caverton Offshore Support Group dropped by 10.51 per cent to N2.30 while Nascon Allied Industries depreciated by 9.67 per cent to N13.55 per share.

Total turnover stood at 1.07 billion shares worth N11.39 billion in 16,346 deals last week compared with a total of 1.09 billion shares valued at N13.39 billion traded 15,774 deals two weeks ago. The financial services sector led the activity chart with 606.44 million shares valued at N5.38 billion in 7,529 deals, representing 56.75 per cent and 47.23 per cent of the total equity turnover volume and value.

The information and communication technology sector staged a distant second with a turnover of 225.576 million shares worth N1.776 billion in 751 deals while the conglomerates sector placed third with a turnover of 66.375 million shares worth N85.924 million in 890 deals.

The three most active stocks were Courteville Business Solutions, United Bank for Africa (UBA) and FCMB Group, which altogether accounted for 402.69 million shares worth N819.83 million in 1,526 deals, contributing 37.68 per cent and 7.20 per cent to the total equity turnover volume and value.

A total of 753 units of Exchange Traded Products (ETPs) valued at N102,213 were also traded in eight deals while a total of 22,242 units of Federal Government bonds valued at N22.56 million were traded in 15 deals last week compared with a total of 5,666 units valued at N5.847 billion traded in 17 deals two weeks ago.