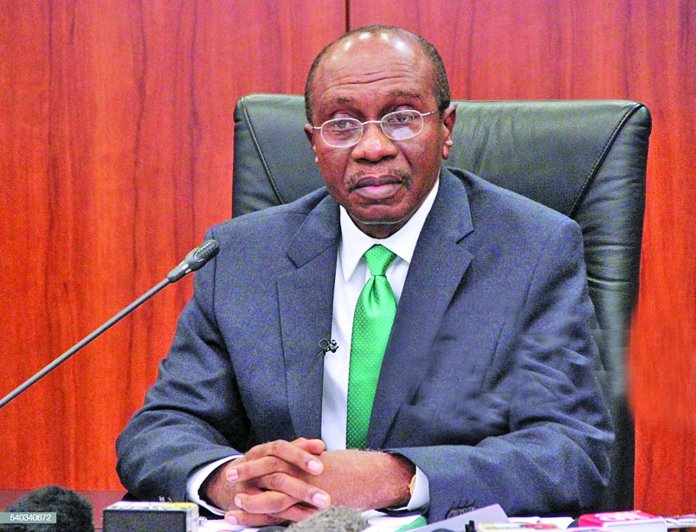

The Central Bank of Nigeria (CBN) Governor, Mr. Godwin Emefiele, has stressed the need to urgently diversify the economy and “create institutional structures that will insulate the economy from oil shocks.”

Emefiele also warned that a potential fall in oil prices could debilitate the economy and adversely impact exchange rate and heighten inflationary pressure.

The CBN governor said this in his personal comment at the January Monetary Policy Committee (MPC) meeting, obtained at the weekend.

The benchmark Brent crude price stood at $56.78 per barrel as at Saturday, $3.22 below the $60 oil benchmark for the 2020 budget.

“I reiterate that even as economic recovery stayed fragile, effective anchoring of inflation expectations remain fundamental.

“Besides, potential fall in oil prices could debilitate the economy and adversely impact the exchange rate with ramifications for inflation.

“It remains urgently imperative to diversify the economy and create institutional structures that will insulate the economy from oil shocks,” he explained.

According to him, following a tepid performance in 2019, global macroeconomic condition is expected to stabilise in 2020, as growth momentum inches up, albeit, sluggishly. According to the International Monetary Fund (IMF), global growth for 2020 is projected at 3.3 per cent, from 2.9 per cent in 2019.

The projection was buoyed by expected positive outcome of the US-China trade talks, favourable execution of Brexit, and ample monetary policy stimulus. Regardless, downside risks subsist and market sentiments remain fragile, especially as heightening geopolitical tensions between US and Iran amplified global uncertainties.

However, for the Nigerian economy, the CBN governor said short-term outlook remained modest while output growth recovery was expected to progress.

He stated that CBN analysis forecast growth at about 2.4 per cent for 2020, from 2.2 per cent estimated for 2019.

This, according to Emefiele, could be accompanied by a gradual rise in inflation over the short-term, driven largely by structural and monetary factors in the domestic space.

“Data by the National Bureau of Statistics (NBS) shows evidence of consolidation in economic recovery as real GDP growth increased to 2.3 per cent in 2019 Q3, from 2.1 per cent in 2019 Q2.

“Analyses indicate that the oil sector grew by 6.5 per cent, contributing 0.6 percentage point to total growth while non-oil sector, with a growth of 1.9 per cent, accounted for 1.7 percentage points with a robust prospect for 2019 Q4 outcome.

“The favourable growth sentiment is supported by positive Purchasing Managers’ Index –both in the manufacturing and non-manufacturing indexes– buoyed by the continued foreign exchange (FX) market stability and the enhanced credit flows to the real private sector of the economy,” he stated.

Emefiele noted that regardless of the upswing, cautious policy was irrefutable as growth was still low while per capita income and unemployment rate remained outside tolerable levels.

“Besides, the modest short-term prospect is threatened by a delicate oil price dynamics, weak aggregate demand, persistent herder–farmer conflicts and prevalent security challenges.

“I am of the view that a favourable resolution of these challenges, reinforced by sustained FX stability, as well as continued implementation of the Loan-to-Deposit Ratio (LDR) policy, will further boost short-term outlook.

“Data on domestic prices shows a displeasing and continued uptick in year-on-year headline inflation rate from 11.85 per cent in November 2019 to 11.98 percent in December, with near-term outlook suggesting a gradual build-up of inflationary pressure up to mid-2020. The observed rise reflects the 0.19 and 0.34 percentage points increases in both food and core inflation to 14.67 and 9.33 per cent, respectively, over the preceding month,” he added.

He said analysis showed that food inflation derived from the Yuletide spending was exacerbated by the adverse effects of security challenges along some food producing belts.

Though near-term upside inflationary risks subsist, the existing foreign exchange stability and ongoing aggregate supply boosting policies of the CBN were expected to continue to dampen emerging pressure, he said.

“Net domestic credit expanded by 27.3 per cent, reflecting the 92.9 per cent growth in government credits and the 13.6 per cent rise in private sector credits.

“I note the robust and progressing outturn of domestic private sector credits. While this reflects our recent inclination on LDR, I continue to emphasise the importance of enhanced credit flows to strategic private sector ventures through an effective collaboration of all stakeholders.

“I reiterate that CBN will continue to propel credits to the private sector, even as I remain mindful of the risk aversion of banks to supposedly high-risk real sector ventures.

“I note the improvements in banks’ Non-Performing Loans (NPLs) position and our continuing efforts at de-risking the target sectors.

“Robust credits will bolster domestic investment, household demand and factor productivity while accelerating economic diversification, and ensuring strong and inclusive growth,” he added.